In today’s fast-paced digital world, staying ahead in the financial market is crucial for businesses and individuals alike. One of the most powerful tools available for optimizing trading strategies is auto trading software. This groundbreaking technology has revolutionized the way traders operate, providing unmatched speed, accuracy, and efficiency.

What is Auto Trading Software?

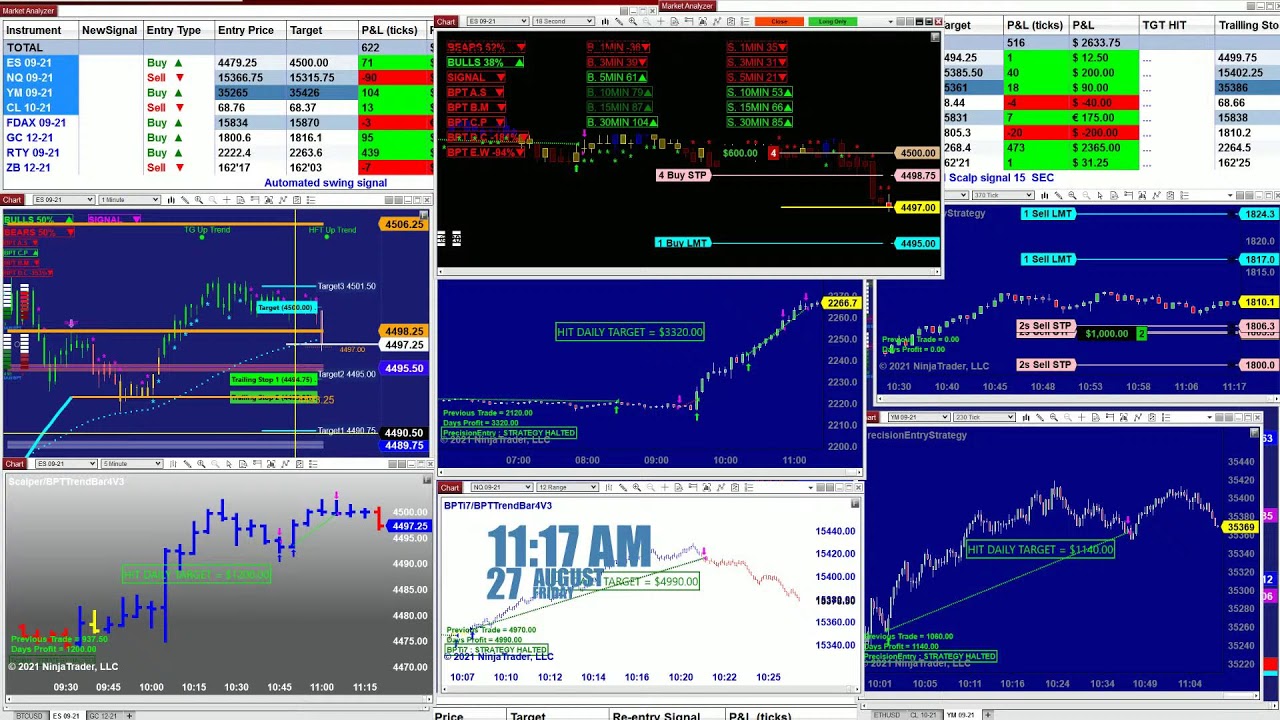

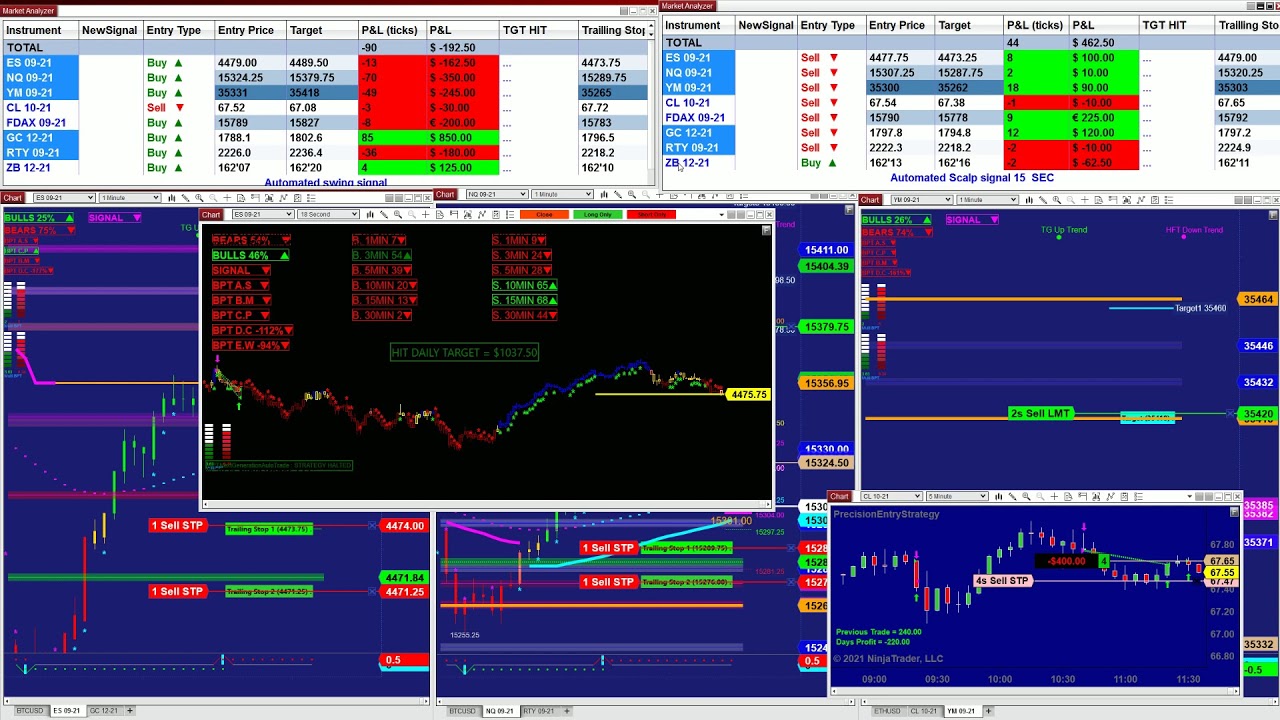

Trading software, also known as algorithmic trading or black-box trading, is a computer program designed to execute trades automatically based on predefined criteria. These criteria can include market trends, price movements, technical indicators, and risk parameters. By utilizing complex algorithms, auto trading can analyze vast amounts of data in real time and make split-second trading decisions without human intervention.

Benefits of Auto Trading Software:

- Speed and Efficiency: One of the primary advantages of software is its speed and efficiency. With automated execution, trades are placed instantly, eliminating delays and ensuring timely responses to market fluctuations.

- Elimination of Emotions: Human emotions such as fear and greed can often cloud judgment and lead to irrational trading decisions. Trading software operates based on preset rules, eliminating emotional biases and maintaining a disciplined approach to trading.

- Backtesting and Optimization: Advanced auto trading software allows traders to backtest their strategies using historical data. This feature enables traders to evaluate the performance of their strategies, identify potential weaknesses, and make data-driven optimizations.

- Diversification: Auto trading software can trade across multiple markets, asset classes, and strategies simultaneously, providing diversification benefits and reducing overall risk exposure.

- 24/7 Monitoring: Unlike human traders who require rest, auto trading software can monitor the markets 24/7, ensuring no trading opportunities are missed, even during non-trading hours.

Key Features to Look For:

When selecting trading software, several key features should be considered to ensure optimal performance and reliability:

- Strategy Customization: The ability to customize trading strategies according to individual preferences and risk tolerance.

- Risk Management Tools: Incorporation of risk management tools such as stop-loss orders, position sizing, and risk-reward ratios.

- Real-Time Market Data: Access to real-time market data feeds and analysis tools for informed decision-making.

- Compatibility: Compatibility with multiple trading platforms and brokerage accounts for seamless integration.

- Technical Support: Responsive technical support and ongoing updates to address any issues or enhance functionality.

Choosing the Right Auto Trading Software:

With a plethora of auto trading software options available in the market, selecting the right one can be daunting. Here are some tips to help you make an informed decision:

- Research: Conduct thorough research on different auto trading software providers, comparing features, user reviews, and track records.

- Trial Period: Opt for platforms that offer a trial period or demo account, allowing you to test the software’s functionality and suitability for your trading style.

- Security: Prioritize platforms that adhere to stringent security protocols to safeguard your sensitive financial information.

- Performance Track Record: Evaluate the platform’s performance track record, including historical returns, drawdowns, and risk-adjusted metrics.

- User-Friendly Interface: Choose auto trading software with an intuitive and user-friendly interface, making it easy to navigate and customize settings.

The Future of Auto Trading Software

As technology continues to evolve, the future of trading software looks promising. Advancements in artificial intelligence, machine learning, and big data analytics are further enhancing the capabilities of automated trading software, making it more intelligent, adaptive, and efficient.

Auto trading software represents a paradigm shift in the world of trading, offering unparalleled speed, accuracy, and automation. By leveraging this powerful tool effectively, traders can optimize their strategies, mitigate risks, and stay competitive in today’s dynamic markets.

Check out our YouTube channel to learn more about automated trading software.